by Gary Marchiori, President, EnergyMark, LLC

Northeast Bottleneck Will Be Relieved by Pipes

Relief for the Northeast producer is near. Expansions on existing rights of way and pipeline additions will increase the take away from core Marcellus Dry gas production zones in North East Pennsylvania, flowing gas to cons trained markets in the region and to Canada, Mid Atlantic and the South East. These increased flows will cause the financial effect of tightening the negative location value (basis) of Northeast US gas to Henry Hub and financial futures. Two recent examples of these FERC approved pipeline expansions are the Northern Access 2016 and Atlantic Sunrise projects, their detail follows:

National Fuel Northern Access Pipeline

National Fuel Northern Access Pipeline

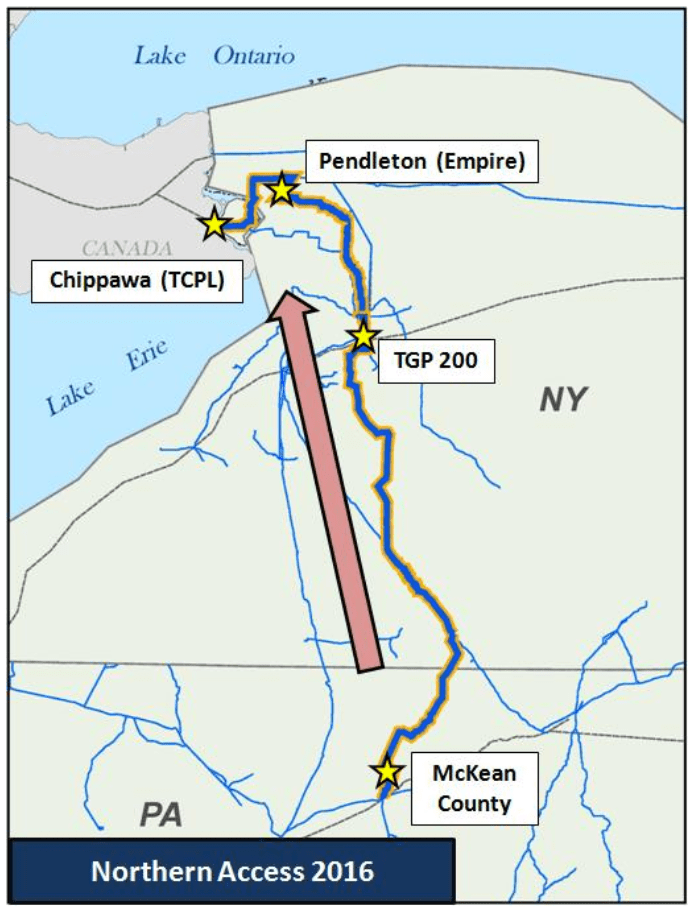

The Northern Access 2016 project is likely to bolster dry gas production in north-central Pennsylvania, targeting NFG’s Seneca Resources acreage there via a roughly 96.5-mile, 24-inch-diameter pipelinethat would transport that gas toward Erie County, New York, adjacent to the Canadian Border.

From there, 350 MMcf/d of the project’s capacity would reach the US-Canada border, flowing into TransCanada’s system via the Chippewa interconnect on Empire Pipeline. The remaining roughly 150 MMcf/d would reach Tennessee Gas Pipeline’s system in Erie County, New York.

In this region, flows on Tennessee’s 200 Line, which tie in with the new National Fuel infrastructure, generally serve New England and New York City demand, either via on-system deliveries or by way of Iroquois Gas Transmission’s system.

National Fuel’s system has become a major point of export over the past several years, spurred by previous expansion projects such as the original Northern Access expansion, a project distinct from the similarly named to the Northern Access 2016 project.

Reversal of flows, have occurred. As recently as 2009, National Fuel received an average 180 MMcf/d of imported gas from TransCanada, and Empire Pipeline. Empire separately brought in an average 230 MMcf/d. With the commissioning of Northern Access capacity in late 2012, flows quickly reversed, and National Fuel delivered an average 250 MMcf/d to TransCanada in the 12 months following that project’s in-service date.

An additional 140 MMcf/d was brought online in late 2015 with the Northern Access 2015 expansion, which led to a reversal of flows at the Empire-Chippewa interconnect with TransCanada, leading to a consistent volume of roughly 150 MMcf/d of US-to-Canada exports, above and beyond the roughly 300 MMcf/d that now flows from National Fuel to TransCanada.

Over the past 12 months, the two systems have facilitated a combined 455 MMcf/d of exports to Canada at the Niagara and Chippewa interconnects.

Atlantic Sunrise Project

On February 2nd, FERC approved the Atlantic Sunrise expansion project, a proposed 198-mile pipeline running through 10 Eastern Pennsylvania counties to connect Marcellus Shale natural gas from PA to Williams’ Transco pipeline in southern Lancaster County. Construction is expected to begin in 3Q17 with completion in mid-’18 adding 1.7 bcf/d to Transco delivery capacity of NE Marcellus gas to Mid-Atlantic and Southeast markets. The Atlantic Sunrise anchor shippers are Cabot Oil and Gas along with National Fuels’ Seneca Resources.

The pipeline project will help alleviate the serious transportation capacity deficiency in the Marcellus.

While production in the Marcellus boomed in the last ten years, pipelines lagged behind. With limited available transportation infrastructure, Appalachian producers have faced very low prices for natural gas. While recent improvements have shrunk the Marcellus-Henry Hub price gap, there are still significant infrastructure deficiencies. The $3 billion Atlantic Sunrise expansion of 1.7 bcf/d capacity will aid producers attempting to get their products to market.

While transport capacity south is the bottleneck for the majority of the year, in winter the reverse is true. When northeastern cities like New York and Boston demand more natural gas than the infrastructure can supply, local spot prices can rise dramatically. Atlantic Sunrise will also add the ability for the main pipeline to flow gas in either direction, reducing this problem.

The effect of these macro changes to flows in our pipeline infrastructure to our local producer will be improvements in location value, with a rising tide raising all ships.